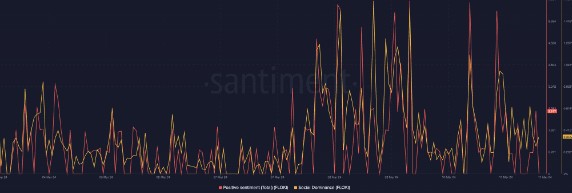

The distinguishing feature of the bull market is that there will be at least two to three major midway adjustments during the entire process, and after each adjustment, it will continue to advance rapidly;Unless it is the last decline, the previous declines are all for a better rise, and then they are higher and higher. When the last adjustment occurs, the bull market will end and fall off the cliff;Then, it is very important to judge as accurately as possible which decline is for a better rise and which rise is in the final "crazy" period.Each track is rotating, market sentiment is skyrocketing, opportunities are increasing, and the assets in hand are beginning to increase in value exponentially. In this process, the time I spend on tweeting will increase, and the number of dinner parties will become more and more frequent, precisely in order to judge as accurately as possible how "crazy" the public is for the current bull market. Emotionally speaking, this is an important basis for judgment.This stage is the so-called Niu Chu. Niu Chu is the time when there are the most opportunities and the fastest time to accumulate capital. In the bear market, everyone pretends to be dead, and the market is completely silent; at the peak of the bull market, everyone is close to going crazy, with fewer opportunities and more deceptive things; only in the early days of the bull market, there are many opportunities and relatively high returns.At this time, don’t be afraid of falling, and discover as many opportunities as possible. You must find a way to retain your principal and select the one with the best return-to-income ratio among the many opportunities, place a heavy bet, and then in the mad bull stage when the emotion is highest, Sell out the assets you first established in stages. Only after such a cycle can your wealth achieve a qualitative leap.As for how to judge the last adjustment, or the bearish stage of a possible sharp decline, the judgment comes from only: emotional theory + specific market conditions.Emotions were discussed earlier. As for the market, the normal bull market advancement process should be "increasing volume and increasing prices", which means that the trading volume of the subsequent rising wave should be greater than the trading volume of the rising wave before the adjustment. If there is an obvious deviation in any wave of rise, that is to say, the transaction volume of the new wave of rise has not reached a new high, or is even smaller than the previous wave, but the points have repeatedly reached new highs, this is highly dangerous. is a signal, indicating that the market may change at any time.You know, once a change in this situation occurs, it will be extremely lethal.In this stage of sprinting to the top, do not be fooled by the skyrocketing market value of your account every day. You must clearly realize that trend investment cannot be at the top, and there will inevitably be a certain degree of profit retracement. If you still keep watching If you look at the highest market value of your account and imagine it to be at the highest point, you will be no different from the vast majority of red-eyed gamblers. You will most likely be influenced by luck and eventually survive the entire "Crazy Bear". A tragic ending.Because when people face losses, they always like to take risks. This is the weakness of human nature. It is very easy to lose reason due to losses, thus ignoring greater risks and choosing to go all-in.

热点: BULL HOW TO