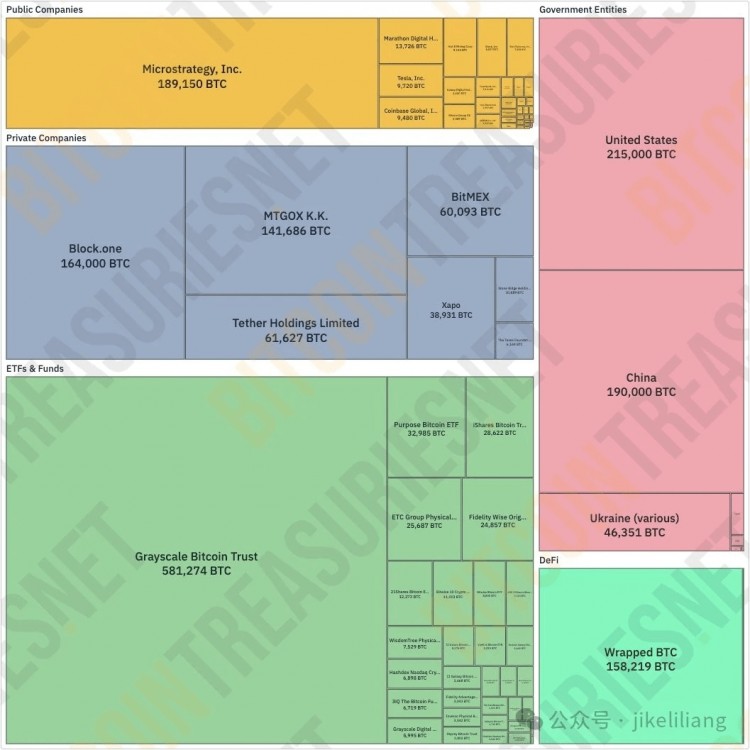

Let’s talk briefly. The pie reached 48,000 US dollars on New Year’s Eve. I mentioned before that grayscale selling pressure cannot change the trend. I have written quite a few bullish articles in the past month. Someone once called me Duojun leader who was fooled by being trapped. I find that there are always people comparing Bitcoin to the U.S. dollar. Bitcoin cannot replace the U.S. dollar, nor can it become the U.S. dollar. In the tide of history, the U.S. dollar will also decline. This is a matter of course. There are several reasons why the U.S. dollar became the world currency. At the Bretton Conference in 1944, the U.S. dollar was pegged to gold for the first time in a fixed equivalent value, the so-called Bretton Woods system. Secondly, during World War II, the United States was on the other side of the earth for a long time. Friends who know why Japan attacked Pearl Harbor should know how much the United States profited from World War II. This laid the foundation for a century of prosperity. There is also something interesting here. During World War II, in addition to commercial cooperation between Japan and the United States, the United States was also helping weak countries resist Japan. While selling war resources, while helping vulnerable groups resist Japan, money has two sides, and policy also has two sides. The other is strong military strength. When the Bollington Woods system was about to collapse, the famous Gulf War occurred. A war that terrified all countries and established the dollar's status in the energy era. The reason why the U.S. dollar is badmouthed is actually very simple. There are bottlenecks in technology, energy, finance, etc. The same goes for the U.S. dollar. In the past thirty years, the U.S. dollar has lost a lot of currency credibility. It has endlessly abused sanctions. If it gets tough, it will even sanction its own younger brother. For example, after the Toshiba incident in Japan, Japan no longer dared to produce high-end products. I used to be depressed about why Japanese cars were of such good quality but there were no high-end products. Even Japanese car owners only wanted small and exquisite cars. Later, after learning about the Toshiba incident, I realized that it was because we did not dare to compete with the West for high-end market share. But just because Japan doesn’t dare, doesn’t mean that the whole world doesn’t dare. At least we do. There are bottlenecks in science and technology, military capabilities, and finance. Whether a multipolar world will be formed depends on the attitude of multiple parties, rather than the attitude of unilateral sanctions. At least now, more and more opponents have taken advantage of it. We are currently at the beginning of the Fourth Industrial Revolution. Although the United States is still leading the way, it does not mean that other countries do not have opportunities.

热点: DOLLAR THE U