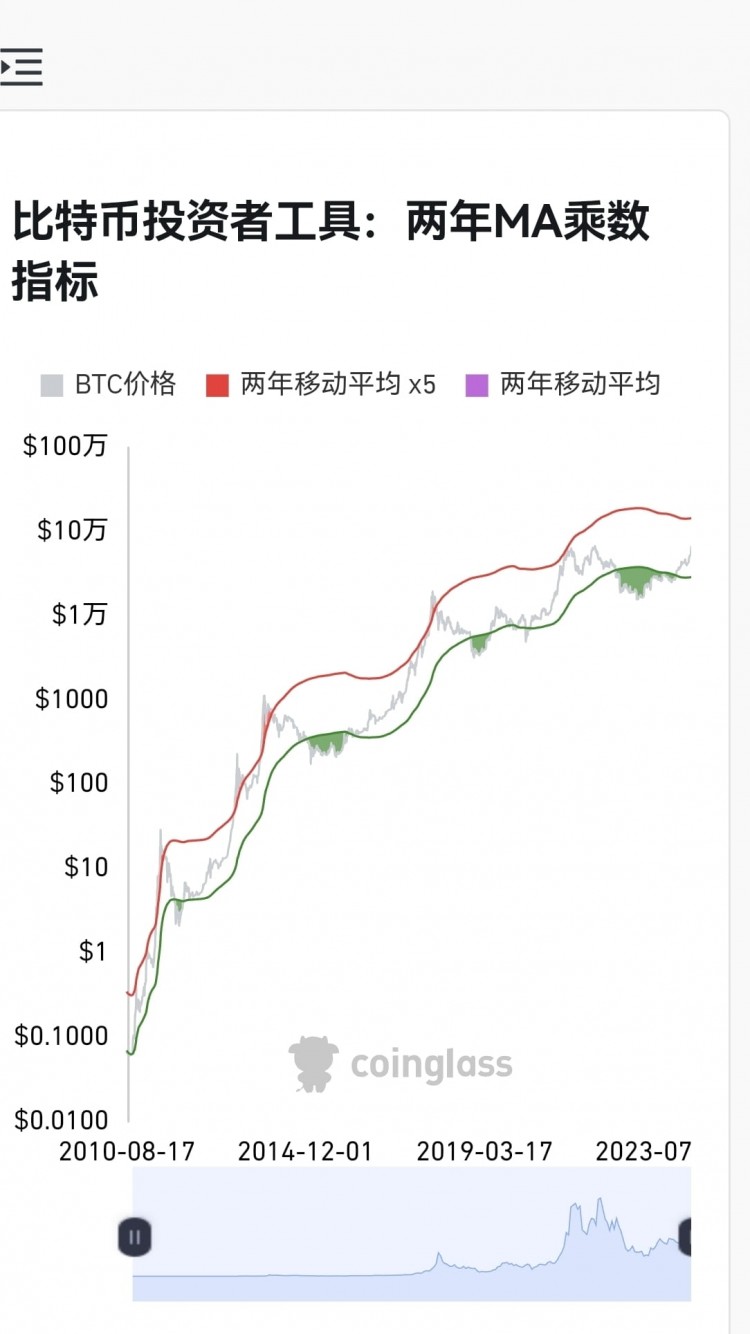

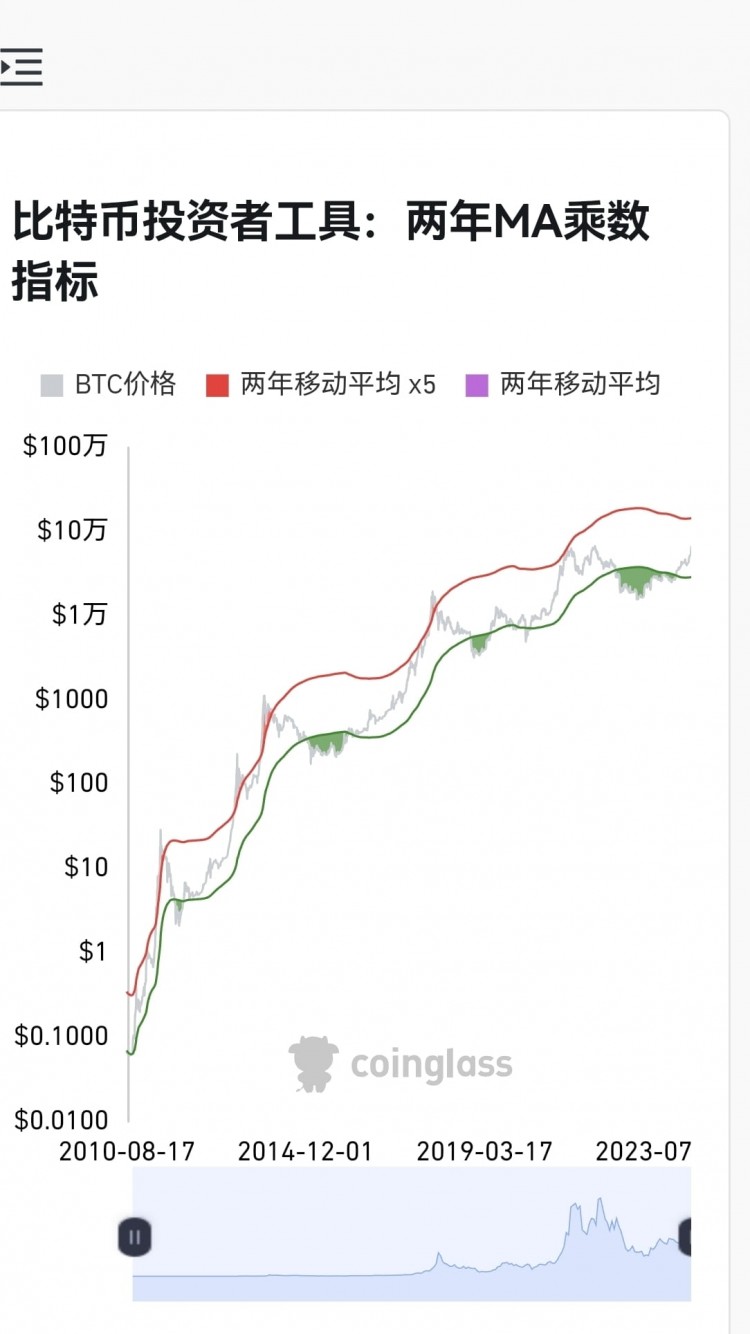

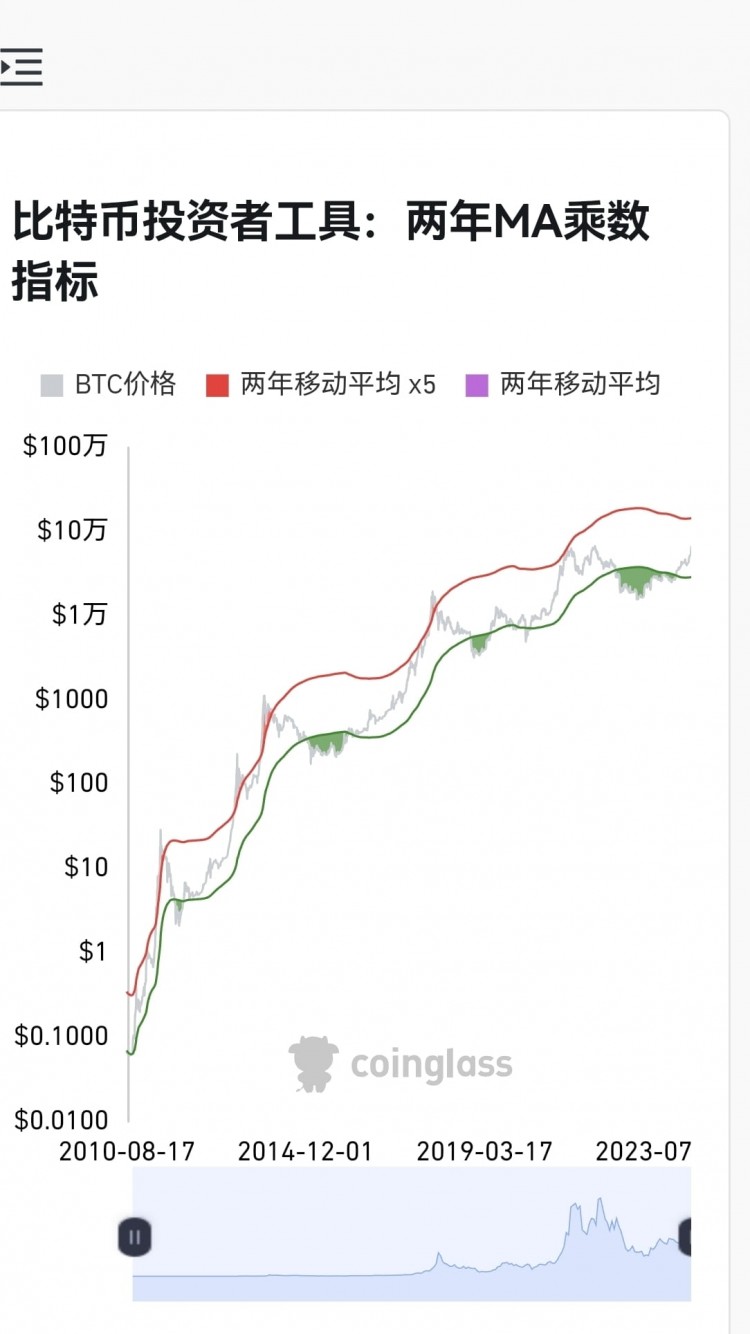

The time to test your knowledge has arrived! After Bitcoin hit a historical high, it quickly corrected, and the corresponding ETFs all turned green. Many people said that Bitcoin only surged after the halving. Unfortunately, his assets have now been halved!Just like the script analyzed in my previous article, this wave of Bitcoin will be a process of continuous fluctuations and upwards. Every correction will be a test of cognition. For example, the current correction will be a good time for leeks to get on the spot. Chance.Let’s look at the macro perspective. First of all, the U.S. debt is growing too fast. Basically, 1 trillion U.S. debt will be added every 100 days. Data from the U.S. Treasury Department shows that starting from the second half of last year, the growth of U.S. debt has accelerated significantly. In June last year After reaching 32 trillion US dollars on the 15th, it reached 33 trillion US dollars on September 15. As of February 28, the U.S. debt was $34.4 trillion. Prior to this, it took about eight months for the U.S. debt scale to increase from US$31 trillion to US$32 trillion.And as debt expands rapidly, 'credit devaluation' trades are approaching all-time highs, which is why the prices of gold and Bitcoin, among others, have soared. In the short term, there is no good solution to this problem. Either you default and refuse to repay, or you have to let the interest rate depreciate. No matter which one, Bitcoin will gain.In addition, let’s look at the technical aspects. Bitcoin’s MVRV-Z index reflects the bubble situation of Bitcoin. When its value is overvalued, there will be a large price bubble. Compared with the previous bull market, the index has not reached a very high value at present, and is only in the middle position at most. The price curve is almost the same as the previous round, so from a valuation perspective, Bitcoin is still relatively Large safety distance.Additionally, we look at the two-year MA Multiplier indicator, which highlights the periods during which buying and selling Bitcoin will yield huge returns. If it falls below the green line, buy the bottom, and if it breaks the red line, sell. Now the price has only moved a little less than half.Therefore, the correction is a good opportunity to get on the train, and it is also a reward for patient investors. However, it is estimated that many leeks have been exploded during this wave of correction. After the correction, they will wait for a bigger correction. This is human nature.

热点:Bitcoin A TEST